Super Gann Trader Academy which conducts stock market courses in Delhi, offers free trader awareness lessons.

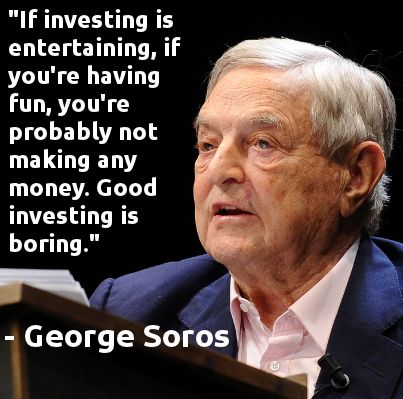

Average people like trading because it gives them excitement. They trade on tips and hunches, which are a hit or miss system. This hit or miss is very addictive because our brain loves random rewards. Video games are designed to use this weakness of random rewards in our minds.

Average people like trading because it gives them excitement. They trade on tips and hunches, which are a hit or miss system. This hit or miss is very addictive because our brain loves random rewards. Video games are designed to use this weakness of random rewards in our minds.

When average traders make money, they give themselves credit for winning. When they lose they always find someone else to blame. They want to make some profit every day. Hence, they trade on a daily basis, as though they are working on daily wages. This causes them to overtrade. Overtrading is the biggest evil in the game of speculation.

A trader can have three positions while trading.

Long position – When the trader has bought a stock, commodity or forex futures, in anticipation of rise in its price.

Short position – When trader has sold a stock, commodity or forex futures in advance, hoping to buy it back at later date and make money due to anticipated decline in prices.

Out of market: A trader is said to have an out of market position when he is waiting for his trading system’s next signal to enter the market.

Staying out of the market is, often, the best position for a trader. Traders and investors generally make money in trending markets. ‘Trend is your friend’ is a true statement in the stock market.

70% percent of the time market is consolidating or fluctuating. Only 30% of time market is trending either up or down.

Profitable traders are aware of this. These successful traders follow a methodology or a trading system which they have tested to be profitable. They trust their system to guide them in the market. This helps them wait till the time is right, when reward-to-risk ratio is in their favor, as indicated by their trading system. They have a dispassionate attitude towards trading, and are not excited by market action. They have patience to wait for the correct time to enter. They also exercise patience to hold on to winners.

Hence, for profitable trading, we need to learn to wait. First, we keep waiting for the correct time to enter as indicated by the trading system. Then we wait for the trading system to give us the next signal to move our stops, or exit from the market. Therefore, we are only waiting and watching our trading systems signal, even when we are in a trade.

Hence, for profitable trading, we need to learn to wait. First, we keep waiting for the correct time to enter as indicated by the trading system. Then we wait for the trading system to give us the next signal to move our stops, or exit from the market. Therefore, we are only waiting and watching our trading systems signal, even when we are in a trade.

Hence, most of the time, a trader is only waiting and watching. This is very boring. However, this kind of boring trading is very rewarding because it brings in profits.

The question you need to answer is:

The question you need to answer is:

Are you trading for profits or excitement?

Trading system based trading may be boring but it is profitable. Join our share market classes in Chennai for advanced level training program to acquire trading skills. You will learn our trading system and low-risk trading.

Here the List of Blogs in this Series

- What is herd behavior?

- The best investment?

- Is good trading boring?

- Learn swimming or Trading both are same

We are active on following Social Medias